Understanding Poppo Live Payment Methods in South Africa

What is Poppo Live and Poppo Coins

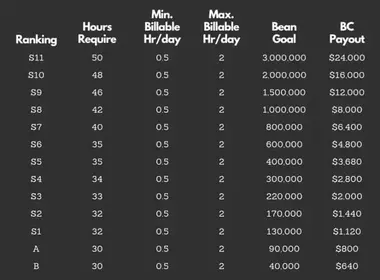

Let’s start with the basics. Poppo Coins are your ticket to everything fun on the platform - sending gifts to streamers, unlocking premium content, joining special events. The math works out pretty well for creators too: they get a 70% revenue share with a minimum withdrawal of 100,000 points (that’s $10 USD), processed within 1-7 business days.

New users? You’re in luck. Daily tasks can net you 20,000 points daily - essentially $2 just for showing up.

The app itself needs iOS 12.0+ and about 263.7 MB of storage. It’s owned by Vshow PTE. LTD. and runs on that classic freemium model where coins are basically the key to everything interesting.

Available Payment Options Overview

South African users have three main routes: direct in-app card payments, voucher systems through third-party platforms, and bank transfers via external services. The in-app stuff integrates with Google Play and the App Store, supporting whatever credit or debit cards you’ve got linked.

But here’s where it gets interesting - third-party platforms support over 700 payment methods across 123+ currencies. We’re talking Mobile Money, PayPal, local banking solutions, the works. For Poppo voucher top up solutions, BitTopup stands out with competitive pricing, instant delivery, and solid customer support. They’ve specifically designed their system for South African users, which honestly makes a huge difference.

1Voucher for Poppo Live: Complete Guide

How Voucher Systems Work

Voucher systems are pretty straightforward - you buy digital codes that last 12 months, get unique redemption codes from authorized resellers. The beauty here? No direct financial linking to apps, you can gift them, and there are often promotional discounts.

The process is simple: buy your code externally, then redeem it through the app’s voucher section. Benefits include better privacy, gift functionality, and cost savings since you’re avoiding those hefty app store fees.

Step-by-Step Purchase Process

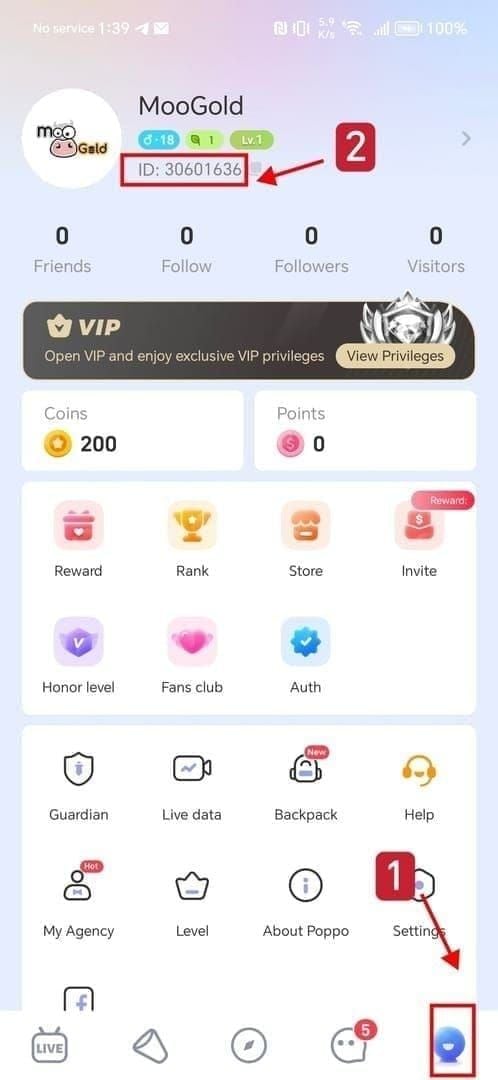

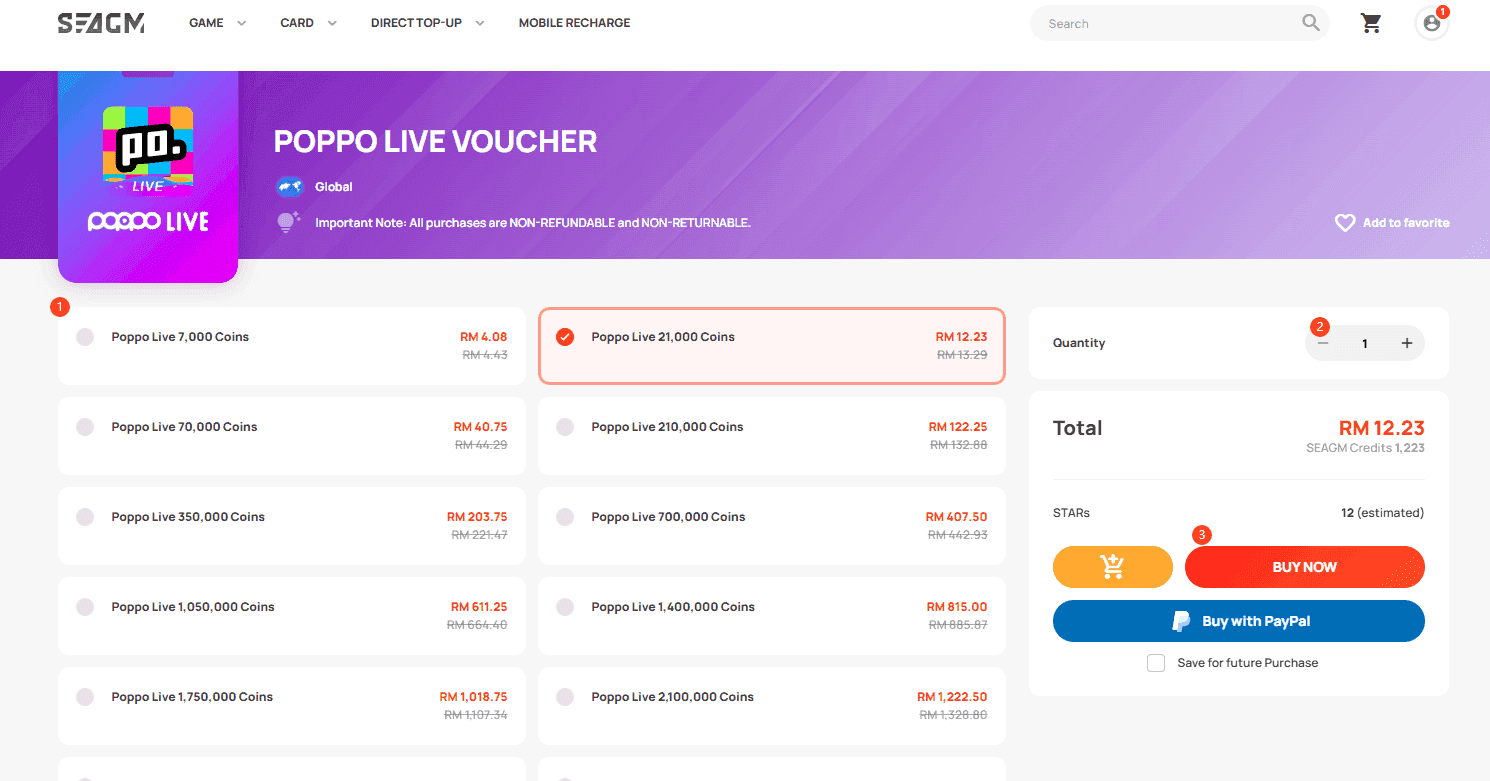

Preparation phase: First, grab your Poppo Live User ID from your profile section. Figure out how many coins you need, then research reputable sellers - track records matter here.

Purchase phase: Hit up a third-party platform, pick your coin package, enter that User ID carefully (this part’s irreversible, so double-check), choose your payment method. Mobile Money’s usually an option. Complete the transaction and wait for your email code.

Redemption phase: Open Poppo Live, navigate to your wallet, select voucher redemption, enter the code exactly as provided, confirm, and boom - instant coins.

Voucher Costs

Here’s where third-party platforms really shine - they avoid those brutal 15-30% app store surcharges. You’re looking at up to 20% savings. A $50 purchase gets you 458,000 coins versus 430,000 in the official store. That’s 28,000 bonus coins, which works out to about 6.5% additional value.

Even smaller $10 purchases save you roughly 4.6% compared to official pricing. Bulk purchases? Even better discounts across all tiers.

Card Payments on Poppo Live

Supported Cards and Limitations

In-app payments run through Google Play and Apple App Store systems, supporting major credit and debit cards. But - and this is a big but - South African users constantly report payment declines, especially on iOS where you’re stuck with card-only options.

The app store systems just don’t play nice with South African banking networks, even when your card is valid and funded. It’s frustrating, honestly.

Card Payment Process

The process itself is dead simple: launch Poppo Live, hit up your profile wallet, select your coin package, tap purchase, follow the app store prompts with your linked payment method. When it works, you get instant coins.

But when it doesn’t work? You’re stuck with limited options and basically no recourse for those card declines.

Security and Costs

Card payments do benefit from app store security - encryption, fraud monitoring, the whole nine yards. But you’re paying for it with currency conversion fees, international transaction charges, and higher base prices thanks to app store surcharges.

Direct card linking also exposes you to charges from multiple platforms without any cost optimization benefits.

Bank Transfer for Poppo Live

Direct Transfer Limitations

Here’s the thing - bank transfers aren’t available as in-app payment methods. Nigerian users have been specifically requesting this feature because of persistent card decline issues. It highlights some serious payment infrastructure gaps.

Without direct bank support, users get pushed toward third-party services that accept local transfers as payment options.

Third-Party Banking Solutions

External platforms do accept transfers from major South African banks, converting local currency to Poppo Coins. For direct Poppo coin purchase through banking methods, BitTopup provides comprehensive banking support with competitive exchange rates and transparent fees.

Processing takes 1-3 business days with order tracking and customer support. Larger transactions might need verification - transfer proof, identity confirmation, that sort of thing.

Cost Comparison Analysis

Fee Structure Breakdown

In-App Costs: Base prices plus those killer 15-30% app store fees, international transaction fees, currency conversion charges, and zero promotional discounts.

Third-Party Costs: Reduced base prices that avoid surcharges, up to 20% bulk discounts, competitive exchange rates, multiple payment options that reduce banking fees.

Detailed Price Analysis

Let’s break down the numbers:

$10 Comparison: Official store gives you 83,000 coins for $10.00. Third-party? Same 83,000 coins for $9.54. That’s 4.6% savings right there.

$50 Comparison: Official gets you 430,000 coins. Third-party delivers 458,000 coins - that’s 28,000 bonus coins, or 6.5% additional value.

Bulk Benefits: 7,000 Coins save up to 6%, 21,000 Coins save up to 10%, and 700,000 Coins offer significant volume savings in the $76-$92 range.

Hidden Costs

In-app purchases hit you with unfavorable exchange rates and international fees. South African banks tack on additional fees for international app store purchases. Third-party platforms? Transparent pricing with competitive ZAR conversion rates and upfront total cost display.

No surprises.

Speed and Convenience Comparison

Processing Times

In-App: Instant when it works, but those frequent declines create delays. Voucher Systems: 2-5 minutes from purchase to redemption with immediate coin credit. Bank Transfers: 1-3 business days including verification, but reliable for users who can’t use cards.

User Experience

In-app offers the simplest interface but fails way too often for South African users. Third-party platforms require a few extra steps but provide superior reliability and payment flexibility. Despite the added complexity, the experience is actually better.

Security and Safety Analysis

Security by Method

In-App: App store security protocols with encryption and fraud monitoring. Third-Party: Varies by platform - reputable sellers offer secure gateways, SSL encryption, customer protection. Banking: Traditional bank security plus platform verification for international transactions.

Risk Assessment

Primary Risks: Scam sellers, incorrect User ID entry (remember, it’s irreversible), payment exposure, voucher expiration after 12 months.

Protection strategies: Verify seller track records, double-check those User IDs, use secure payments with buyer protection, redeem vouchers promptly, contact support immediately if something goes wrong.

Expert Recommendations

Method Selection Guide

Choose In-App When: You’ve got a reliable international card, convenience trumps savings, you make small infrequent purchases, or you just prefer integrated experiences.

Choose Third-Party When: Cost savings are priority (especially bulk purchases), in-app keeps failing, you need diverse payment options including Mobile Money, you’re buying gifts, or you need actual customer support.

Choose Bank Transfer When: No international card access, you prefer banking security, you’re making larger purchases where time isn’t critical, or other methods have failed.

Money-Saving Strategies

Buy bulk during promotions for maximum discounts. Compare multiple reputable platforms. Take advantage of new user bonuses. Time your purchases during sales events. Consider vouchers for gifting efficiency.

Always calculate total costs including fees, use methods with favorable exchange rates, avoid multiple small purchases, and keep an eye on promotional offers from established platforms.

FAQ

What’s the cheapest way to buy Poppo Coins in South Africa? Third-party platforms offer up to 20% savings compared to in-app purchases. BitTopup provides competitive pricing with bulk discounts - a $50 purchase yields 28,000 bonus coins versus official pricing.

Why do card payments keep getting declined on Poppo Live? International payment processing issues and app store limitations cause frequent declines for South African users. Banks often block international app purchases as fraud prevention. Contact your bank for authorization or switch to third-party platforms with Mobile Money options.

How long does it take to receive coins through different methods? In-app: instant when successful. Vouchers: 2-5 minutes. Bank transfers: 1-3 business days. All methods credit immediately once payment’s confirmed.

Are third-party platforms safe for buying Poppo Coins? Reputable platforms are safe when you choose established sellers with positive track records, 24/7 support, secure gateways, and clear refund policies. Just avoid anything with unrealistic discounts or weird payment requests.

Can I get refunds for wrong account transfers? Nope, all coin transfers are irreversible once processed. Always verify your Poppo User ID multiple times before completing payment.

Which South African banks work best? Major banks (Standard Bank, FNB, Nedbank, ABSA, Capitec) can work for international purchases, but success varies wildly. Third-party platforms often provide better local banking integration than direct app store payments.