Understanding VAT on Bigo Recharges: 2025 European Landscape

VAT applies to all digital goods purchased in the EU and UK, including Bigo Live diamonds. Official channels automatically add VAT based on your billing address or IP location, directly increasing transaction costs.

The EU VAT Directive classifies Bigo diamonds as electronically supplied services under destination-based taxation—you pay VAT at your country's rate, not the provider's location.

Platforms like BitTopup offer buy Bigo Live coins United States through tax-efficient jurisdictions, providing legal alternatives to standard recharge methods.

Country-by-Country VAT Breakdown (EU & UK 2025)

- Germany: 19% VAT (38 Diamonds: €0.99 + €0.16 VAT = €1.15 total)

- UK: 20% VAT (starter packs: £0.90 + £0.18 VAT)

- Slovakia: 23% (effective Jan 1, 2025)

- Estonia: 24% (effective July 2025)

- Netherlands: 21% (effective Jan 1, 2025)

- EU average: 21.8% weighted mean

A €100 diamond purchase incurs €19 tax in Germany, €20 in UK, €23 in Slovakia, €24 in Estonia.

How VAT Adds 15-25% to Your Spending

Monthly impact:

- €50/month in Germany: €9.50 VAT annually (€114 yearly)

- €50/month in UK: €10 VAT monthly (€120 yearly)

- €500/month: €1,140-€1,200 annual tax

For broadcasters, minimum cashout is 6,700 Beans ($31.90 USD at 210 Beans/dollar). Weekly cap: 1,050,000 Beans with $3 base fee + 2%. Freelancers face tax obligations at €600 annual income, VAT registration at €22,000 revenue.

Recent Tax Law Changes

- MOSS threshold: €10,000 allows small sellers to avoid multi-country VAT registration

- Intra-EU threshold: €35,000 triggers detailed transaction reporting

- UK threshold: £85,000 for HMRC registration (higher than EU)

- Visa Direct partnership (Nov 1, 2023): Faster payments, standard VAT still applies

Legal vs Illegal: Defining Tax Avoidance

Tax avoidance (legal): Minimizing tax through legitimate means—choosing lower-tax jurisdictions, using compliant platforms registered in favorable locations.

Tax evasion (illegal): Falsifying records, using VPNs to misrepresent location on official channels, failing to report bean cashout income.

What the Law Says

EU/UK tax law focuses on seller obligations, not buyer location choice. Platforms registered exclusively in non-EU jurisdictions without European operations may not have VAT collection obligations, creating legal arbitrage.

The reverse charge mechanism applies to B2B transactions only—individual consumers can't use this for personal purchases.

Safe Harbor Practices

Use platforms with:

- Transparent business registrations

- Clear terms of service

- Established payment infrastructure

- Official Bigo Live API integration

Never use VPNs to fake location on official channels—this constitutes fraud.

Common Misconceptions Debunked

Myth: All third-party recharge violates Bigo's TOS. Reality: Bigo accepts diamonds from authorized resellers using legitimate sources.

Myth: All VAT avoidance is illegal. Reality: Tax authorities distinguish legal optimization (choosing lower-tax options) from illegal evasion (concealing transactions).

Geographic Arbitrage: How Location Affects Tax

Geographic arbitrage exploits legitimate tax differences between jurisdictions. Hong Kong maintains 0% VAT on digital goods—a 19-24 point advantage over Europe.

When platforms operate from Hong Kong selling to European customers, they follow Hong Kong tax law. No European VAT collection because they lack taxable presence in EU jurisdictions.

Low-VAT Jurisdictions 2025

- Hong Kong: 0% VAT (28-33% total discount vs European prices)

- Singapore: 9% GST

- UAE: 5% VAT (many digital services exempt)

- Switzerland: 8.1% VAT (non-EU)

Cross-Border Transaction Mechanics

Your payment goes to a Hong Kong entity → purchases diamonds from Bigo wholesale/partnership channels → delivers to your account. Payment processors route through international banking, converting currency, processing payment, confirming delivery in seconds.

Legal Framework

International trade law permits consumers to purchase digital services from any worldwide provider. No EU/UK regulation prohibits choosing providers in favorable tax jurisdictions. VAT collection obligation falls on seller, not buyer.

Platform Selection: VAT-Optimized Recharge Services

Payment platforms determine tax jurisdiction through business registration location, not your physical location. Hong Kong-registered platforms apply 0% VAT regardless of customer location.

BitTopup processes transactions through tax-efficient jurisdictions with proper licensing, secure gateways, and official Bigo integration. For safe Bigo Live diamonds top up, verify platform registration and processing location.

How Platforms Determine Tax Jurisdiction

Corporate registration location determines governing tax authority. Hong Kong incorporation = Hong Kong tax law, even when serving international customers (provided no permanent establishment elsewhere).

Registration Location Impact

- EU-registered platforms: Must charge VAT at customer's location rate

- Non-EU platforms without EU presence: May not have VAT collection obligations

Direct vs Third-Party Tax Implications

Direct recharges: Automatic VAT based on account location, billing address, or IP. App version 6.37.3+ supports VAT checks (Oct 9, 2025). No optimization opportunities.

Third-party platforms: Operate independently from low-tax jurisdictions, avoiding European VAT obligations. Identical diamonds, lower total price.

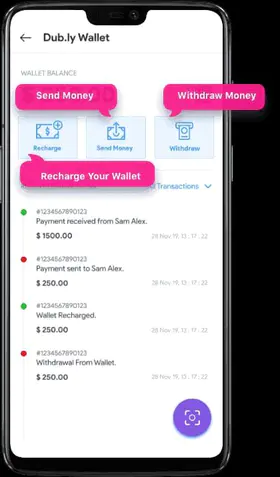

Step-by-Step: BitTopup Recharge for Maximum Savings

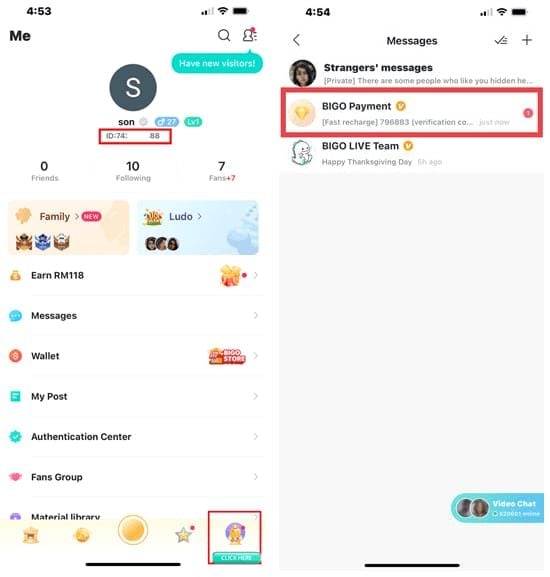

Account Setup

- Open Bigo Live app → ME page

- Copy Bigo Live ID (under nickname)

- Enable 2FA with phone passcode

Select Payment Method

Choose methods with buyer protection:

- International credit cards (chargeback rights)

- PayPal (dispute resolution)

- Avoid methods lacking protection

For UK players, select GBP packages to minimize conversion fees. Mid-week top-ups process faster.

Complete Transaction

- Input Bigo Live ID on platform

- Select diamond amount → Buy Now

- Choose payment method

- Review total (no VAT on zero-tax platforms)

- Complete secure payment

- Receive confirmation

Confirm Delivery

Diamonds appear within 5-15 minutes. Check:

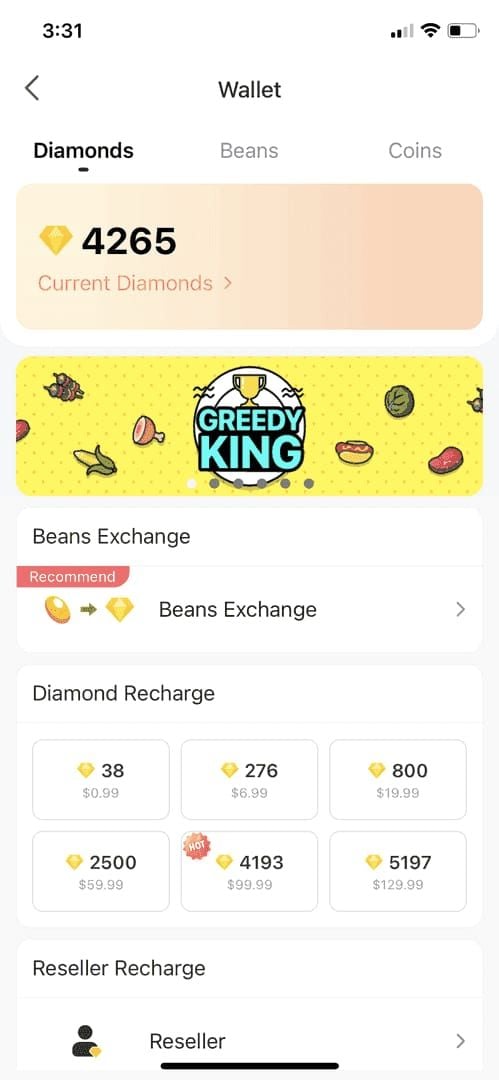

- Wallet → Diamond balance

- Profile → Wallet → Transaction History

- Export receipt/save as PDF

Maintain records 12+ months for potential tax inquiries.

Real Savings Breakdown

Price Comparisons (Germany)

210 Diamonds:

- Official: €1.19 (incl. 19% VAT)

- Optimized: €0.83-€0.95

- Savings: €0.24-€0.36 (20-30%)

276 Diamonds:

- Official: €8.19 (€6.99 + €1.20 VAT)

- Optimized: €5.75-€6.50

- Savings: €1.69-€2.44

850 Diamonds:

- Official: €19.99

- Optimized: €14.00-€16.50

- Savings: €3.49-€5.99

Monthly Savings (Regular Spenders)

€50/month (Germany):

- Official VAT: €98.28 annually

- Platform fees: €10-€15

- Net savings: €83-€88/year

£50/month (UK):

- Official VAT: £120 annually

- Net savings: £100-£105/year

Annual Savings (High-Volume)

€500/month:

- Official VAT: €1,140-€1,440 annually

- Platform fees: €50-€100

- Net savings: €1,040-€1,390/year

€1,000+/month:

- Annual savings: €2,000-€2,500 (VAT only)

- With platform discounts: €3,500-€4,200 total

ROI Calculator

Positive ROI at €10+ monthly spending. Setup time: 10-15 minutes. Break-even: first transaction.

Payment Method Optimization

Payment Methods and VAT

Platform registration determines tax, not payment method. All methods = 0% VAT on Hong Kong platforms.

Focus payment selection on fees, security, convenience.

International Cards vs Local Options

International cards (Visa/Mastercard/Amex):

- Universal acceptance

- Strong buyer protection (chargeback)

- 1-3% conversion fees

Local options (SEPA/iDEAL/Sofort):

- Lower conversion fees

- Weaker buyer protection

- Better for established platforms

E-Wallet Advantages

PayPal, Skrill, Neteller provide:

- Security layer between bank and merchant

- Dispute resolution

- 2-4% international fees

- Faster processing (5 vs 15 minutes)

Cryptocurrency

Pros: Maximum privacy, <1% fees Cons: Zero buyer protection, irreversible, potential capital gains tax obligations

Generally unsuitable unless you already hold crypto and understand tax implications.

Risk Management

Verify Platform Legitimacy

Check for:

- Business registration info, physical address

- SSL certificates (HTTPS)

- Privacy policy, terms of service

- Independent reviews, community feedback

BitTopup maintains transparent operations with verifiable credentials and established support.

Account Security

- Never share Bigo password (only Bigo ID needed)

- Enable 2FA, login notifications, device authorization

- Review login history regularly

Transaction Monitoring

- Maintain records: dates, amounts, platform names, confirmation numbers

- Export receipts from platform and Bigo

- Monitor payment statements for unauthorized charges

If Issues Arise

- Check Bigo transaction history

- Refresh app, verify connection

- Contact platform support with transaction ID

- Document all communications

- Dispute with payment provider within 60-120 days if needed

Advanced Strategies

Volume Discount Stacking

Combine:

- Platform volume discounts (15%)

- VAT elimination (20%)

- Total: 35% savings

Purchase bulk during promotions. Diamonds don't expire.

Business Account Treatment

Registered businesses may reclaim VAT on business expenses. Requires:

- Proper business/VAT registration

- Documentation proving business use

- €22,000 annual threshold for VAT registration

Seasonal Variations

Monitor:

- Regulatory changes (Estonia VAT increase July 2025)

- Platform promotions (10-20% additional)

- Combined savings: 50%+ possible

Multi-Currency Advantages

Pay in strongest currency for 2-5% additional savings on large purchases (€500+). Monitor exchange rates if you maintain multi-currency accounts.

Common Pitfalls

Tax Authority Red Flags

- Don't mix business/personal accounts

- Do report bean cashout income above €600 threshold

- Recharge optimization ≠ income tax exemption

Platform Red Flags

Avoid platforms:

- Offering 50%+ discounts (fraud indicators)

- Requesting Bigo password

- Asking to disable security

- Lacking verifiable reviews

Legitimate optimization saves 20-35%, not 50-70%.

Documentation Requirements

- Purchases €1,000+: Prepare ID, proof of address, source of funds

- Keep receipts €100+: Tax audit protection

- Broadcasters/businesses: Comprehensive records mandatory

Staying Compliant

- Use transparently registered platforms

- Never falsify location/identity

- Maintain accurate transaction records

- Monitor tax law changes

Future-Proofing: 2026 Regulation Changes

Proposed EU Reforms

EU Commission refining digital services taxation. Proposed:

- Non-EU platforms above revenue thresholds must collect VAT

- €10,000 MOSS threshold may be lowered/eliminated

- Target implementation: 2026-2027

UK Post-Brexit Policy

- Potential divergence from EU approaches

- £85,000 HMRC threshold remains

- Possible UK-Hong Kong bilateral agreements

Stay Informed

- Subscribe to tax authority newsletters (HMRC, national authorities)

- Follow European Commission taxation directorate

- Monitor industry publications (digital commerce, fintech, gaming)

- Join Bigo community forums

Adapt Your Strategy

- Diversify across multiple platforms

- Time major purchases before regulatory changes

- Monitor platform communications about compliance

- Build relationships with reputable providers

FAQ

Do I pay VAT on Bigo diamonds in Europe? Official channels: yes (19-24%). Hong Kong-registered platforms: no—they operate under different tax law without EU VAT obligations.

Is VAT avoidance legal? Yes, through legitimate platforms in favorable jurisdictions. This is legal tax avoidance (choosing lower-tax options), not illegal evasion (concealing transactions).

How much can I save? Direct VAT savings: 19-24%. Hong Kong platforms often add 28-33% discounts. Total savings: 35-50% vs official European pricing.

Does BitTopup charge VAT? No. BitTopup operates through tax-efficient jurisdictions, enabling VAT-free purchases for European customers.

Can I use VPN to avoid VAT? No—using VPN to misrepresent location on official channels is fraud, violates TOS, risks account bans and legal consequences.

What if caught evading VAT? Tax evasion: penalties, back taxes, interest, potential prosecution. Legal avoidance through international platforms: no risks—you're choosing where to purchase based on legal price differences.

Save up to 33% on every Bigo recharge! Visit BitTopup for VAT-optimized diamonds with instant delivery, secure transactions, and 24/7 support. Join thousands of European players reducing Bigo costs legally through strategic platform selection.