Understanding SMS Payment Caps on Poppo

Mobile carrier billing limits block Poppo coin purchases through strict spending thresholds. SMS payments cap at $5-$25 per transaction, monthly limits range $10-$100 depending on carrier and account history. For UK users, Poppo recharge Australia platforms like BitTopup bypass carrier limits, delivering coins in 1-5 minutes.

What Are Mobile Carrier Billing Limits?

Carriers enforce protective spending thresholds on digital purchases. Two levels operate simultaneously:

- Per-transaction caps preventing large single purchases

- Cumulative monthly caps tracking total spending across all digital services

- 24-48 hour processing delays conflicting with time-sensitive Poppo events

Common SMS Payment Error Messages

Error 1001: Insufficient funds or monthly cap reached (not actual balance issue) Error 1004: 3D Secure authentication timeout/rejection Error 1006: Geographic restrictions blocking international gaming purchases Error 1007: Bank blocking gaming transactions—requires authorization for purchases exceeding $100. Bank pre-approval reduces decline rates by 85%.

Why Carriers Impose Spending Restrictions

Carriers minimize fraud risk and customer disputes over unexpected charges. Live streaming platforms generate high transaction volumes triggering risk management systems. Regulatory pressure prevents excessive digital spending. Maximum 3 payment attempts per 24 hours with 15-30 minute waits between attempts.

Country-Specific Thresholds: UK, Sweden, Germany

UK: 20% VAT increases costs 15-25% vs. digital methods. Monthly caps:

- Vodafone: £10-£75

- EE: £20-£60

- O2: £10-£50 (based on tenure)

- Three: £15-£40

Sweden: EU VAT 17-27%. Carriers enforce:

- Telia: 200 SEK/transaction, 500 SEK/month

- Tele2/Telenor: 150-250 SEK/transaction, 400-600 SEK/month

Germany: PSD2 requires strong authentication for €30+ transactions, causing timeouts:

- Deutsche Telekom: €25/transaction, €50/month

- Vodafone DE: €20/transaction, €60/month

- O2 Germany: €15/transaction, €40/month

How SMS Billing Works for Poppo

Direct carrier billing routes purchases through mobile operator infrastructure, adding charges to phone bills. Process involves:

- App sends request to carrier gateway with phone number, amount, transaction ID

- Gateway authenticates device, verifies account, checks spending limits

- System generates SMS confirmation code (60-second entry window)

- 24-48 hour processing queue before coin delivery

Verification frequently fails due to network delays, SMS issues, or timeouts, consuming one of three daily payment attempts.

Hidden Fees with SMS Payments

- Processing fees: 5-15% above displayed price

- International transaction fees: 2-8%

- Currency conversion markups: unfavorable exchange rates

- Combined fees increase costs 20-30% vs. digital methods

When SMS Billing Fails

SMS billing works for occasional users making small purchases under $10 who can wait days for delivery. It fails for:

- Active users needing immediate coin access

- Frequent purchases or larger packages exceeding carrier limits

- Time-sensitive events requiring instant gifting

Identifying Your Payment Limit Issue

Check current billing cycle position and total digital purchases in past 30 days via carrier's mobile app under billing details or digital services spending.

Checking SMS Billing Status

Access carrier account portal → digital services → view current spending against monthly limits. Verify:

- Cumulative totals across all apps (not just Poppo)

- Payment attempt counter (resets every 24 hours)

- Zero remaining attempts = wait full reset period

Distinguishing Carrier Blocks vs. Poppo Errors

Carrier blocks: Generic decline messages without error codes Poppo errors: Numbered codes (1001, 1004, 1006, 1007)

Test by attempting purchase on different app using carrier billing. If that fails too, carrier restricted your account.

Understanding Reset Cycles

Carrier limits reset on rolling 30-day cycles from first digital purchase, not calendar months. First purchase on the 15th = reset on 15th of following month. Contact carrier to confirm specific reset methodology.

Instant Bypass Solution: Alternative Top-Up Methods

Digital payment platforms eliminate carrier involvement, processing through independent gateways. Success rates:

- PayPal: 98-99%

- Credit cards with 3D Secure: 60-80%

- Delivery: 1-5 minutes

Platforms connect directly to Poppo's recharge API using your User ID (8-10 digit code below profile picture), removing all carrier limits and delays.

BitTopup: Carrier-Independent Instant Recharge

BitTopup processes Poppo purchases through secure gateways supporting PayPal, credit cards, digital wallets. Delivers coins in 1-5 minutes with no monthly caps or transaction limits. Operates in UK, Sweden, Germany, and 150+ countries with automatic VAT application. For Sweden/Germany users, Poppo Live top up UK methods provide identical instant delivery.

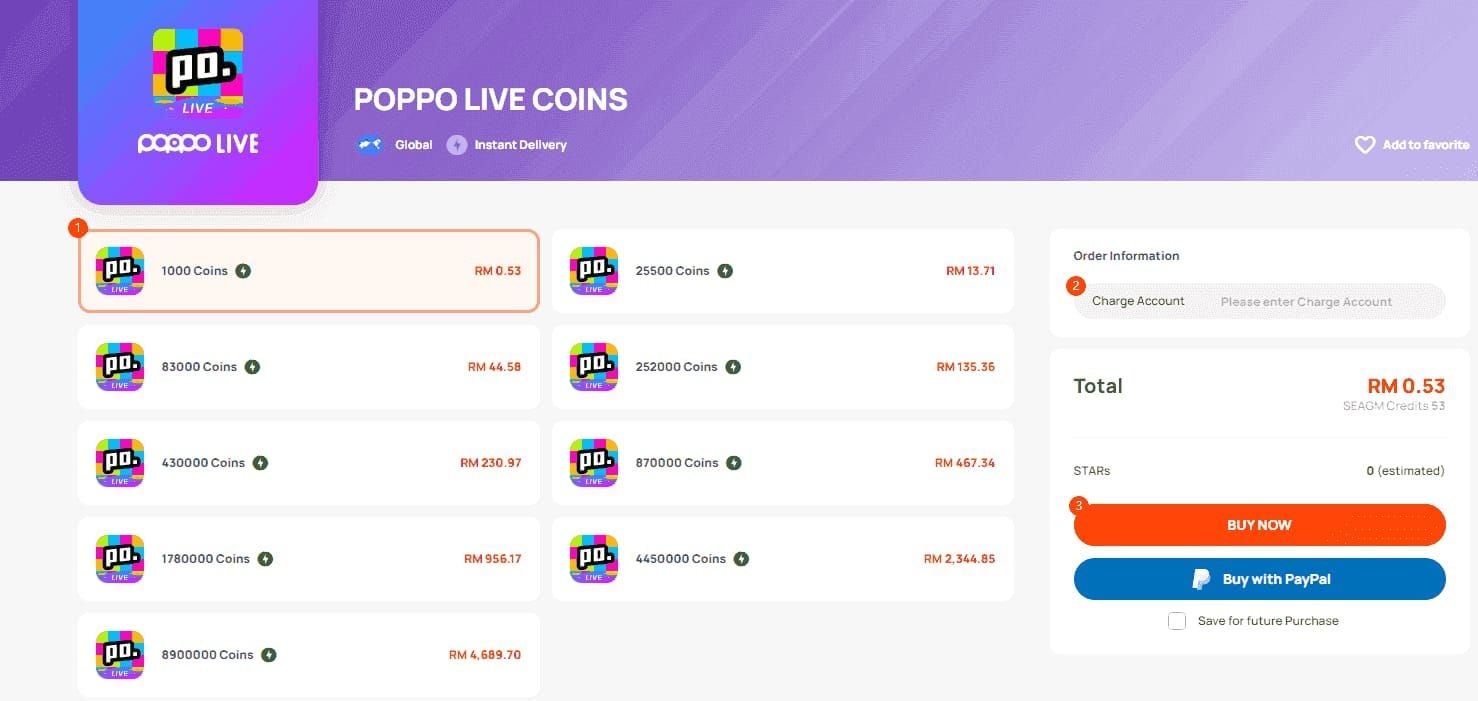

Step-by-Step: Top Up Without SMS Limits

- Open Poppo → tap profile icon → copy User ID (8-10 digits below profile picture)

- Navigate to BitTopup's Poppo page → enter User ID

- Select coin package (210,000+ coins unlock 20% bonus)

- Choose payment method (PayPal/credit card/digital wallet)

- Complete payment through secure checkout

- Coins appear in 1-5 minutes

Verify delivery by checking coin balance in app profile section.

Processing Time Comparison

SMS billing: 24-48 hours, no real-time updates, uncertain success Digital platforms: Under 5 minutes for 95% of transactions

- PayPal: 1-2 minutes

- Credit cards with 3D Secure: Under 60 seconds post-authentication

Complete BitTopup Guide

No account required for basic purchases—just User ID and payment method. Account creation (under 2 minutes) enables order tracking and faster repeat checkout.

Payment Options Bypassing Carriers

PayPal: 98-99% success rate, 1-2 minute delivery. Navigate: Profile > Coins > Top Up > Select PayPal > Login > Confirm

Credit cards: 60-80% success rate with 3D Secure verification (adds 30-60 seconds). Verify card details carefully: all digits correct, CVV matches, billing address uses proper format.

Delivery Timeline

95% of transactions complete within 1-5 minutes. After payment confirmation, BitTopup submits User ID and coin amount to Poppo's API for real-time crediting.

If coins don't appear within 5 minutes:

- Verify correct User ID entry

- Check email for delivery confirmation

- Contact support with order number if exceeds 10 minutes (occurs in <1% of transactions)

Country-Specific Payment Landscape

UK Carrier Policies

Vodafone: £25/transaction, £75/month (standard accounts) EE: £20/transaction, £60/month (calendar month reset) O2: £10/month first 6 months → £50 for established accounts Three: £15/transaction, £40/month (strictest policies)

All include 20% VAT, making carrier billing impractical for active users.

Sweden Telecom Restrictions

Telia: 200 SEK/transaction (€18), 500 SEK/month (€45)

Tele2/Telenor: 150-250 SEK/transaction, 400-600 SEK/month

- 25% VAT applied

- PSD2 authentication for €30+ causes frequent timeouts

Germany Carrier Landscape

Deutsche Telekom: €25/transaction, €50/month Vodafone Germany: €20/transaction, €60/month O2 Germany: €15/transaction, €40/month

PSD2 compliance requires strong authentication for €30+, creating practical ceiling for carrier billing.

Regulatory Differences

UK: VAT collection and consumer protection focus EU (Sweden/Germany): PSD2 mandates two-factor authentication for €30+, adding complexity causing carrier billing failures

Digital platforms handle strong authentication in under 60 seconds vs. carrier systems exceeding timeout thresholds.

Common Misconceptions

Myth: 24-Hour Wait Resets SMS Limit

False. 24-hour reset applies only to payment attempt counter (3 attempts/day). Monthly spending cap resets 30 days from first digital purchase in current cycle. Waiting doesn't address monthly cap—requires switching to carrier-independent methods.

Myth: Carriers Can Increase Poppo Limits

False. Representatives can't modify limits except for business upgrades or tenure milestones (12-24 months). Carriers don't differentiate between apps—limits apply universally across all digital services.

Myth: Different Payment Methods Share Same Cap

False. Carrier billing limits apply only to mobile operator gateway purchases. Digital platforms operate independent systems that don't count against carrier limits. You can exhaust SMS billing while maintaining unlimited purchasing through PayPal/credit cards on BitTopup.

Truth: How Gateways Track Spending

Carrier gateways track via phone number, aggregating all digital purchases into single spending total. Digital platforms track via payment method (PayPal account, card number) separate from phone number, imposing no monthly Poppo caps.

Strategic Top-Up Planning

Timing Purchases Around Events

Poppo runs bonus coin events during holidays, anniversaries, cultural celebrations—increasing value 15-30% vs. standard pricing. Monitor in-app announcements and event calendar. Purchase larger packages during promotions, but ensure consumption before 12-month expiration.

Bulk vs. On-Demand Cost Analysis

Bulk (210,000+ coins): 20% bonus = 16.7% cost reduction per coin. Justifies upfront investment for users spending $100+/month.

On-Demand: Flexibility for casual users but sacrifices bonus value. Calculate 3-month average consumption to determine if bulk saves money.

Managing Multiple Payment Methods

Maintain 2+ active methods for uninterrupted access:

- Primary: PayPal (98% success rate)

- Backup: Credit card

- Avoid carrier billing as primary due to limits and delays

VIP Membership Considerations

Calculate VIP tier's monthly coin requirement + 10% buffer for gifting and events. Maintain coin buffer above minimum to prevent status lapses. Digital payment's 1-5 minute delivery reduces buffer needs vs. carrier billing's 24-48 hours.

Troubleshooting Payment Declines

Error Code Interpretation

Error 1001: Insufficient funds—verify payment method has balance + 10% buffer Error 1004: 3D Secure timeout—retry with careful verification Error 1006: Geographic restrictions—disable VPN during transactions Error 1007: Bank blocking gaming purchases—contact bank to authorize international gaming transactions $100+, whitelist Poppo merchant codes

Account Verification Issues

Level 5 verification requires:

- Government-issued ID

- Address proof dated within 90 days

- ID selfie

- Processing: 24-48 hours

Check verification status in settings before purchases exceeding $50.

Geographic Restrictions and VPN

VPN triggers errors as payment systems detect location mismatches. Disable all VPN before purchases. If restrictions persist, contact payment provider to confirm they support international gaming transactions from your location.

When to Switch Payment Methods

Switch permanently when decline rates exceed 30% over 10 attempts—indicates systematic incompatibility. Persistent Error 1007 despite bank authorization means bank's fraud systems conflict with gaming patterns. Switch to PayPal/digital wallets (98% success) vs. traditional banking (60-80%).

Security and Safety

Why Carrier-Independent Methods Offer Better Privacy

Carrier billing creates detailed records on phone bills visible to account holders/family members. Digital platforms process independently—transactions show only on payment method statements with generic merchant descriptions.

Avoiding Unauthorized Charges

Carrier systems sometimes duplicate charges when retrying failed transactions without waiting 15-30 minutes between attempts. Digital platforms provide immediate confirmation and prevent duplicates through gateway systems.

Two-Factor Authentication

Enable 2FA on Poppo: Settings > Security > Two-Factor Authentication. Activate on payment methods (PayPal, digital wallets) for layered security.

Recognizing Legitimate Services

Legitimate platforms like BitTopup:

- Never request Poppo password (only User ID)

- Use secure HTTPS connections

- Display recognized payment gateway logos

- Provide customer service contact info

Fraudulent services request password access—avoid completely.

Cost Comparison: SMS vs. Digital

Hidden Markup Fees in Carrier Billing

- Processing fees: 5-15%

- International fees: 2-8%

- VAT: 20-25%

- Total markup: 25-35% above base price

£10 purchase costs £12.50-£13.50 on phone bill after all fees.

Exchange Rate Advantages

Digital platforms: 1-2% above interbank rates Carrier billing: 3-5% markup

Difference: £2-£5 per £100 spent = £50-£100 annually for regular users.

Long-Term Savings

Users spending £100/month pay £240-£300 annually in unnecessary fees through carrier billing vs. digital platforms. Combined with 20% bonus coins at 210,000+ threshold, digital platforms save 30-40% annually.

Promotional Offers

Digital platforms offer 15-30% bonuses during holidays/events. Carrier billing rarely includes promotions. BitTopup runs platform-specific promotions independent of Poppo's official events. Combining both yields 40-50% more coins vs. carrier billing.

FAQ

Why does my Poppo SMS payment keep getting declined? You've exceeded carrier limits ($5-$25/transaction, $10-$100/month), exhausted 3 daily attempts, or triggered verification timeouts. Switch to BitTopup—bypasses carrier restrictions, delivers coins in 1-5 minutes with 98% success rates.

What is the SMS payment limit for Poppo in the UK? £15-£25/transaction, £40-£75/month depending on carrier. Vodafone: £25/£75, EE: £20/£60, O2: £10-£50, Three: £15/£40. All include 20% VAT.

How do I bypass mobile carrier restrictions on Poppo? Use your User ID (8-10 digits below profile picture) to purchase through BitTopup. Independent payment gateways eliminate SMS limits, deliver coins in 1-5 minutes via PayPal/credit cards/digital wallets.

Can I top up Poppo without using my phone bill? Yes. Digital platforms allow direct purchases using PayPal (98% success), credit cards (60-80% success), or digital wallets. Enter User ID, select package, complete payment, receive coins in 1-5 minutes—no phone bill charges.

What happens when you hit the carrier billing cap? All SMS payments fail until monthly limit resets 30 days from first digital purchase. System allows 3 attempts/24 hours with 15-30 minute waits. Switch to carrier-independent methods for immediate access.

How long does SMS billing restriction last? Monthly restrictions reset on rolling 30-day cycles from first digital purchase (not calendar months). Daily attempt limits (3 max) reset every 24 hours but don't affect monthly cap.

Skip SMS payment caps—top up Poppo coins instantly with BitTopup! No carrier limits, no waiting, just immediate access for gifting, VIP status, and live interactions. Get coins in minutes, not days. Start your instant top-up now with BitTopup!